The Indian startup ecosystem showed the path to a promising future through innovation and digitization despite the effects of the coronavirus outbreak. 2022 saw the emergence of several new unicorns and a great deal of market activity, despite a minor decline in the quantity and value of funding deals.

But, it’s also true outside everything appears to be very simple. A 20-year-old entrepreneur who has access to venture capital money and trendy technology becomes a billionaire.

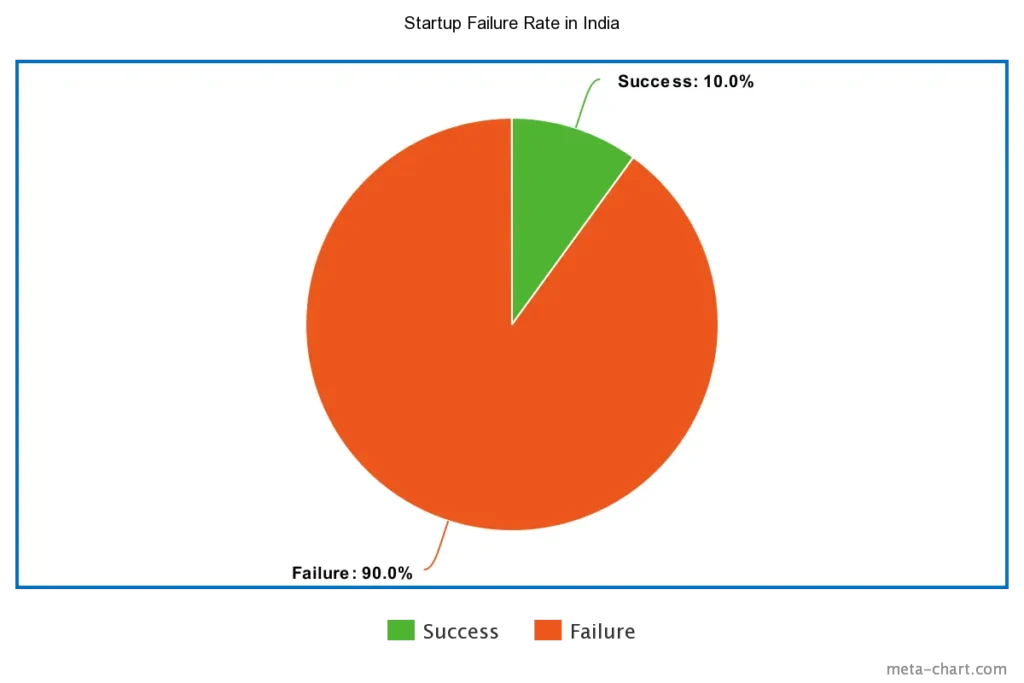

However, there is proof that the number of venture-backed startups failing is much higher than what the sector often claims. And, 9 out of 10 firms fail in the conventional startup ecosystem.

This is due to the founder’s anguish of having to shut down their unsuccessful firm. Unfortunately, founders who choose to launch their businesses in India are continually disappointed.

Key Facts and Statistics of Startups in India

- The ease of doing business study assigns economies a score between 1 and 190 depending on a number of criteria, with 1 being the best. The index score represents the proportion of the best outcome any nation can obtain. A high rating indicates that the regulatory climate is favorable for conducting business.

- India has the youngest startup population in the world with 72% of its entrepreneurs being under the age of 35. The average tenure of startup founders is 28 years.

- One in nine students from the 2013–2015 cohort chose to work for startups or e-commerce enterprises, up from one in 19 from the 2012–2014 batch, according to an ET study. Pay ranges between 10 and 18 lakhs are available in the startup and e-commerce sectors.

- In 2014, there were 3100 startups in the nation, and by 2020, there are projected to be more than 11500. The startup ecosystem employed more than 65000 employees in 2014. In 2020, this number is anticipated to reach 250,000.

- 90% of startup activity in India appears to be concentrated in the top 6 cities: Bangalore (28%), Delhi-NCR (24%), Mumbai (15%), Hyderabad (8%) Pune (6%), and Chennai (6 percent).

- As the upcoming emerging startup locations, Kolkata, Ahmedabad, Kochi, Jaipur, and Thiruvananthapuram are dominant.

- In Bengaluru, 62% of startup founders had prior technical experience.

- 13% of the company’s founders have zero professional experience.

- $2.256 billion (Rs. 14,228 crores) in venture capital investments were made in Bengaluru last year, a 4X increase in funding. By virtue of this, Bengaluru is currently Asia’s 7th-largest investment destination.

The Startup Failure Rate in India

- New business failure statistics – 20% of projects fail at the end of the first year, 30% fail by the end of the second year, 50% fail by the end of the fifth year, and 70% fail by the end of the tenth year.

- 9 out of 10 new businesses failed in India.

- Venture-backed firms fail 7 out of 10 times.

- Only 1% of startups go on to become household names like Uber, Airbnb, Slack, Stripe, and Docker.

- For first-time entrepreneurs, the success rate is 18%.

Sources: Bls.gov, Startupgenome, Drishtiias, TOI

The Startup Success Rate in India in the Last 5 Years

The government said, that India’s startup success rate was far higher than that of other nations’ businesses and that the nation would have 84,012 firms by the end of November 2022, up from 452 in 2016.

Facts Associated with Funding and Investors in India

- Global validation of the skills and vision of Indian startups has occurred. Startups raised $131 billion in funding between 2014 and the first quarter of 2022.

- With cumulative funding of over 892 million dollars as of June 2022, the Gurgaon-based FinTech start-up was the most promising firm for digital lending. Navi, a personal lending marketplace with headquarters in Bangalore and funding of $444 million USD, came in second. A significant online business lending company, Lendingkart, received 231 million dollars in investment.

- Fintech and e-commerce had dominated the funding landscape for entrepreneurs in India. In terms of capital, edtech surpassed fintech in 2021. Direct-to-consumer, food tech, and e-commerce sectors have seen growth in recent years as a result of changes in Indians’ consumption habits since the pandemic’s early years.

- In 2022, artificial intelligence and big data, which accounted for around one-fourth of all global acquisitions over the previous five years, was the most VC-funded startup industry.

- Life sciences, fintech, sophisticated manufacturing, and robotics, on the other hand, each accounted for 10% of the agreements. With only 2%, agriculture, and new food was the smallest sector. However, during the last five years, the industry has seen a 64% growth in funding deals.

Sources: The Hindu, World Scientific, Livemint, YourStory

Startup Industries With the Most Failures

It may seem odd at first, but the information industry has the greatest failure rate. However, the information sector has a low entry barrier and a significant proportion of actual high-risk companies, which may be pushing the average failure rates higher.

Food & Agtech

A failed project example is The Poultry Exchange.

Introducing new technology, particularly digital ones, to an established, traditional industry that may lack early users is a significant barrier for Agtech businesses.

Blockchain

A failing project example is 300Cubits.

Evidently, blockchain has potential. However, it is challenging to put theoretically sound ideas into practice due to the reality of the very volatile and speculative currency market and the lack of knowledge of potential stakeholders with the technology.

Analytics, Big Data, and AI

A failed project example is Roadstar.ai.

Although AI has undeniable long-term potential, the technology is still in its infancy, and it has been difficult to develop economically viable uses for it quickly enough. More so than a business team, many of the most well-known AI businesses (like OpenAI) resemble a fundamental science research team. Many of the investors in this space are taking a long view.

Robotics & Advanced Manufacturing

Unofficially, according to business insiders, 99% of robotics startups fail (!).

There are several causes, but the main one is that robotics startups are trying to solve a very challenging technical issue.

How Many Unicorn Startups Have Survived in the Past 5 Years?

- A billion valuations are not far away. The Unicorn Club is home to 105 Indian businesses in total. In the upcoming year, the numbers are anticipated to increase dramatically.

- 42 Indian businesses achieved unicorn status in 2021, with a market capitalization of above $1 billion. There were roughly 90 unicorn startups as of February 2022. The new members of 2020 received very little investments, in contrast to past years when a select few companies received huge investments and overnight became unicorns.

Sources: Statista

What is a Unicorn Startup?

A startup business valued at more than $1 billion is referred to as a unicorn. In the venture capital industry, it is often used. The term “first” gained popularity thanks to venture capitalist Aileen Lee. Creativity is required since unicorns are so rare. Due to their huge size, unicorn investors are frequently private or venture capitalists, making them unavailable to retail investors.

Name of Some Unicorns Startups

BharatPe – BharatPe is an Indian merchant aggregator, payments platform, and digital payment software that promotes POS and QR-based transactions. Resilient Innovations Private Limited is a private limited corporation, not a government organization. The company, with its headquarters in New Delhi, India, increased its worth to $2.85 billion on August 4, 2021, and it became a unicorn.

FRACTAL – A group of five individuals, including Ramakrishna Reddy, Nirmal Palaparthi, Pradeep Suryanarayan, and IIM Ahmedabad alumni Srikanth Velamakanni, started FRACTAL in 2000. The 21-year-old business offers Fortune 500 companies artificial intelligence and cutting-edge analytics solutions. At a time when Indian startups are crossing the billion-dollar value in 6.6 years, Fractal Analytics is one of a select group of businesses that took more than two decades to join the unicorn club.

Xpressbees – Express delivery services are provided by the e-commerce logistics firm Xpressbees, which was established in 2015 after splitting off from the massive online retailer FirstCry. It delivers more than 1.5 million parcels daily, is present in 3,000 cities, and serves more than 20,000 pin codes. Xpressbees presently runs out of 52 airports in India and has over 10 lakh square feet of warehouse space in over 100 hubs.

Dream11 – Dream11 is an Indian fantasy sports website that offers a variety of sports for Indian sports fans to participate in, including but not limited to cricket, football, hockey, volleyball, handball, futsal, and rugby. Dream 11, a self-developed sports platform, strives to assist Indian sports enthusiasts in growing and showcasing the sports knowledge they are proud of!

Dream11 joined the unicorn league of Indian startups earlier in April 2019 after receiving funding worth $60 million from Steadview Capital and other sources. When Dream11 completed an investment of $840 million in November 2021, its most recent valuation was $8 billion.

Name of Major Startups That Have Failed and Why?

PepperTap – The Indian startup for online grocery delivery, PepperTap, eventually went out of business. With $51 million in venture capital backing, the business was able to attract a sizable and devoted customer base by offering substantial discounts and little overhead. However, the company was losing valuable venture cash on each delivery due to the high costs of last-mile deliveries. The business had to shut down because there needed to be a long-term strategy to turn a profit.

Koinex – In the summer of 2017, Koinex launched in India. It swiftly grew into a significant cryptocurrency exchange, hitting its peak in December 2017. The platform saw a stunning $246 Million in trade volume during that time, and in only 24 hours, it also welcomed up to 45,000 new users!

The goal was to introduce India to the world of cryptocurrency. The platform enabled peer-to-peer trading of popular cryptocurrencies like Bitcoin, Ethereum, Bitcoin Cash, Ripple, and many more.

Frankly.me – Indian users were the focus of the Q&A social site Frankly. me, which allowed users to contact big celebrities directly and ask them questions. Celebrities were more likely to view and respond to questions that received the most upvotes. Celebrities could upload a 90-second video to the platform (referred to as “selfies” or “vlogs”) in which they responded to user-generated content directed at them. Additionally, anyone could register and connect with other individuals by sharing 90-second videos.

The platform’s failure to raise the required round of funding was cited as the reason it was shut down after less than two years on the market.

HotelsAroundYou – An Indian-focused website called HotelsAroundYou specialized in last-minute and brief-stay reservations. Users have the choice to reserve hotels for either a daytime transit stay or a nighttime stay. The app advertised hotels with available rooms and earned a commission when customers made hotel reservations via the app. The app provided a service that was already being provided by a number of competitors with years of user experience and confidence. After failing to secure additional money from investors, HotelsAroundYou quietly folded, with its founders having moved on to other businesses.

Dazo – Strong competition and a lack of capital were two of the primary factors in the decision to close the business. The food technology sector requires significant capital investment, and Dazo began to lack funds.

Because of the intense rivalry in the market, businesses reduced their prices to the point where almost no one could profit significantly from it and the cost of customer acquisition skyrocketed. Naturally, Dazo had trouble raising money, and the business decided to shut down a year after it began.

Doodhwala – Every household makes regular purchases of fresh milk. Indians have always relied on their neighborhood milkmen for milk, but the urban Indian population wanted more than just milk; they required convenience, freshness, and dependability. That was the issue that Doodhwala fixed.

The ease of having a variety of milk is one that neither the neighborhood Doodhwala nor the kirana shop can equal. Doodhwala took pride in having the most assortment of milk. More than 70 different kinds of milk were available on the platform. Doodhwala was the go-to place for all milk needs since it offered choices to satisfy a wide range of dietary needs, whether they were for A2 milk, organic milk, goat milk, camel milk, or lactose-free milk.

Startups That Have Made a Comeback After a Diminishing Fall in the Last 5 Years (Global)

Delta Airlines – According to Forbes, Delta’s 2005 income per seat mile was only 86% of the industry average. In 2005, the firm sought bankruptcy protection, citing rising fuel prices, and during that time fully restructured and revamped itself as rival airlines were swiftly acquired or combined.

In 2007, they came out of bankruptcy, and they’ve been doing well since then. Delta is currently the second-largest airline in the world, according to Business Insider. It has 879 aircraft, just 8 fewer than American Airlines 956.

Lego – Since its founding in 1923, Lego has been a mainstay of the toy business. However, the business started to run into problems at the start of the new millennium. Even though they were able to negotiate licensing agreements for extremely well-known franchises like “Harry Potter” and “Star Wars,” sales fell off as the excitement surrounding the films subsided. However, Lego continued to produce the same volume of stock. Tweak Your Biz, said that Lego was losing $1,000,000 every single day.

In 2004, as Lego was on the edge of bankruptcy, a new CEO was chosen. Now, “The Lego Movie” is one of the most popular and successful films of 2014, and it has inspired two spin-off films, “The Lego Batman Movie” and “The Lego Ninjago Movie”.

Marvel & Marvel Studios – Many of the all-time highest-grossing movies were produced by Marvel and Marvel Studios today. “Avengers: Endgame,” the most recent installment of the Marvel Cinematic Universe, broke box office records.

However, the comic publisher was having trouble earlier in the 1990s. According to Den of Geek, the corporation had high levels of debt and its stock values were declining. Marvel sold the film rights to many of their well-known characters, including the X-Men, Blade, and Spider-Man, in an effort to increase revenue. Marvel wasn’t making a lot of money even when these movies were being produced.

PBR Sales – Beginning in the 1970s and continuing all the way up to 2002, PBR sales were slowly falling. The New York Times reported that the year’s sales saw an increase of a little over 5%. However, the company’s fortunes took a sudden turn in 2014, and it was now valued at $1 billion.

Netflix – In the days following the announcement in 2011, Netflix lost almost 800,000 subscribers, and its stock plummeted. However, “House of Cards” made its debut as the first Netflix Original two years later, and since then there has been no looking back.

List of Reasons – Why Startups Fail in India?

- 35% of startups fail because they spent time, money, and resources creating a good or service that no one wants or needs or that is already available. Even well-known titans occasionally make mistakes.

- The simple fact that startups run out of money is one of the most frequent causes of failure. This can be due to bad money management, an inability to obtain finance or a lack of income.

- A terrible mistake is undervaluing or ignoring your rivals. However, 20% of companies blame their demise on being outperformed by their competitors. Your major competitors may be another startup with a superior offering or marketing plan or an existing business with a sizable and devoted customer base.

- A successful startup requires a solid and long-term business plan. Any business is doomed to failure without a defined plan of operating procedures and revenue generation.

Sources: Entrepreneur, Failory

Government Policies for a Startup in India

- Through a number of initiatives run by the Central Government, 4100+ startups have benefited in the year 2022.

- INR 960 crore in investment for startups has been made available through various policies.

- Infrastructure funds worth 828 Cr were authorized. Through its flagship Startup India project, the government has made an effort to foster a climate that is favorable to business.

- SIP-EIT is a Scheme designed to give MSMEs and technology startup units financial assistance for international patent registration in order to promote innovation and acknowledge the value and potential of global IP.

- For the purpose of starting a new business, the Stand Up India Scheme provides at least one woman, one member of a scheduled caste (SC), or a member of a scheduled tribe with a bank loan between Rs. 10 lakhs and Rs. 1 crore. This company could operate in the manufacturing, service, or trading industries. In the event of non-individual businesses, an SC/ST or woman entrepreneur must possess at least 51% of the stock and the controlling interest.

- For a large number of goods, the Government acts as the sole consumer. In order to increase the percentage of purchases from the small-scale sector, the Government Stores Purchase Scheme was established in 1955–1956. Micro and small businesses (MSEs) are registered with NSIC through the Single Point Registration Scheme (SPRS) in order to participate in government purchases.

- Since the founding of SERC more than 40 years ago, the Extramural Research (EMR) financing scheme of SERB has been in the spotlight. It offers money to universities, labs, and other R&D firms to carry out fundamental studies in all cutting-edge fields of science and engineering. This scheme promotes an individual-centric competitive manner of research funding among eminent and young scientists in the fields of science and engineering. The existing term Extramural Research (EMR) has been changed to Core Research Grant because the scheme supports active researchers’ core research (CRG). The scheme offers active researchers basic research support so they can conduct research and development in cutting-edge fields of science and engineering.

- The Scheme High Risk, High Reward Research encourages and supports fresh suggestions and theories that could revolutionize science and technology. The financial strategy High Risk – High Reward Research aims to advance creative and conceptually risky theories that, if they are adopted, are expected to have a paradigm-shifting effect on science and technology. This could take the form of creating original theories or contributing to the development of new technology through scientific research.

- The National Clean Energy Fund (NCEF) has assisted Indian Renewable Energy Development Agency Ltd. (IREDA) in publishing a revised refinance scheme that details the revival of the operations of existing biomass power and small hydropower projects that have been adversely affected by unforeseen circumstances.

- The IREDA NCEF FINANCE scheme intends to resurrect the operations of the current biomass power and small hydropower projects by lowering the cost of finances for these projects by offering refinancing at concessionary rates of interest, with money coming from the National Clean Energy Fund (NCEF).

Sources: StartupIndia.gov, SSRN

Current Scenario of Startup Growth in India

- India currently has the third-largest startup ecosystem worldwide. The numbers are increasing rapidly, and before long we’ll be at the top with some tough startups up our sleeves.

- To date, 57K businesses have been founded in India. This demonstrates the innovative problem-solving skills of Indians. Shark Tank India is proof that we’re not behind on real-world issues and commercial solutions. In India, there are now 5,068 sponsored startups. These figures are increasing at an encouraging rate.

- Between 2014 and H1 2022, a total of 9.3K investors participated in startup funding. Indian startups are able to generate riches, and investors around the world are becoming interested in them.

- Currently, Indian startups are valued at a total of $450 billion. This is not only encouraging, but it also gives emerging entrepreneurs a boost since they will raise valuations, which will help the Indian economy grow.

- Between 2014 and H1 2022, 1,088 M&A Deals were recorded.

- There are currently 18 Indian Internet companies registered on the stock exchange as the Internet revolution in India has gained momentum.

- Both domestically and internationally, a sizable portion of publicly traded enterprises are based in India. Among them were the online insurance marketplace Policybazaar, the cosmetics retailer Nykaa, and the food aggregator Zomato. The largest initial public offerings in American corporate history occurred in 2021. On the other hand, it was unclear how the future financial situation would be impacted by changes in the world economy. Rising inflation had initially resulted in lesser startup fundraises in 2022 for India in particular, despite an increase in deal count.

- With an estimated 26,000 startups, 26 unicorns (startups valued at over US$1 billion), and US$36 billion in combined investments between 2017 and 2019, India is the third-largest startup ecosystem in the world.

- The ecosystem has grown quickly, primarily due to private investments such as seed, angel, venture, and private equity as well as technical help from incubators and accelerators and governmental initiatives.

Sources: Springer, Livemint, Statista

Conclusion

We hope that by addressing some of the misconceptions surrounding startup and new business failure rates, we were able to help.

Undoubtedly, startups carry a lot of risks, but they also have a lot of opportunities. Potential for advancement and invention that could raise humankind’s standard of living in addition to the potential for financial gains. So don’t let the possibility of failure deter you! Make bold moves!